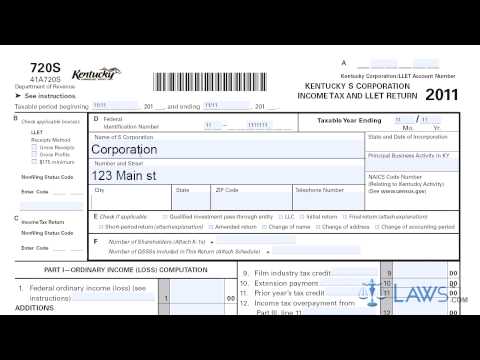

Laws.com legal forms guide Form 720's Kentucky S Corporation Income Tax. Kentucky S corporations filed their state income tax as well as their limited liability entity tax (LL ET) with a Form 720s. This document can be obtained from the website of the Kentucky Department of Revenue. Step 1: At the top of the form, fill in the beginning and ending dates of your fiscal year if not filing on a calendar year basis. Step 2: Indicate your LL ET receipts method with a check mark in Section B. If you are not filing income tax, enter your non-filing status code in Section C. Step 3: In Section D, provide your federal identification number, the end date of your taxable year, your S corporation's name, address, and telephone number, the state and date of its incorporation, its principal business activity within the state, and its NAICS code. Step 4: In Section E, check any applicable statements regarding the status of this return. Step 5: In Section F, write the number of shareholders and the number of QSSs included in the return. Step 6: In Part One, compute income or loss as instructed. Step 7: To complete Part Two, you must first complete the separate Schedule LL ET. Follow the instructions to compute your LL ET. Step 8: In Part Three, follow the directions to compute the income tax. Step 9: Complete the tax payment summary section at the bottom of the form as directed. Step 10: Attach a copy of your federal 1120s return as well as all supporting documentation. Step 11: Complete the Schedule Q questionnaire on the second page and provide all information requested about your company's principal officer. The company's principal officer or chief accounting officer should sign and date the form. To watch more videos, please make sure to visit laws.com.

Award-winning PDF software

Irs 720 Form: What You Should Know

Form 720-X is used Instructions for Form 720-X (Rev. September 2022) — IRS Results 1 – 5 of 15 — Form 720-X, Amended Quarterly Federal Excise Tax Return, 0922, 10/06/2022 Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code About Form 7216, Voluntary Repatriation Request Information about Form 7216, Voluntary Repatriation Request, including recent updates, instructions, and the latest information. Form 7216 is used Instructions for Form 7216 (Rev. January 2018) — IRS Results 1 – 3 of 15 — Form 7216, Voluntary Repatriation Request, 0922, 10/06/2019 Voluntary Tax Returns About Form 8802, Employer Election to Remove U.S. Employee from U.S. Bankruptcy in the Case of Dissolution Instructions for and Form 8802, Employer Election to Remove U.S. Employee from U.S. Bankruptcy in the Case of Dissolution, both are used Instructions for Form 8802 (Rev. April 2018) — IRS Results 1 – 15 of 15 — Form 8802, Employer Election to Remove U.S. Employee from U.S. Bankruptcy in the Case of Dissolution, 0922, 10/06/2019 Voluntary Tax Returns About Form 8632, Foreign Bank and Financial Accounts Disclosure Statement Information about Form 8632, Foreign Bank and Financial Accounts Disclosure Statement, including recent updates, instructions, and latest information. Form 8632 is filed with the IRS and generally used to determine income and deduction from foreign bank and financial accounts. Form 8632 is used Instructions for Form 8632 (Rev.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 637, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 637 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 637 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 637 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 720