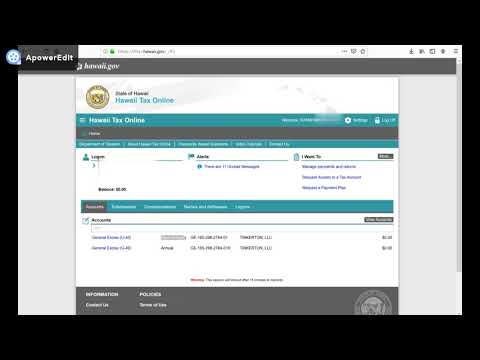

Hello ladies and gentlemen, my name is Raymond. Today we're going to go over the general excise tax for Hawaii. We're going to start with the different surcharges for the different counties as of January 1st, 2019. Then, I'll move into some of the differences between use tax, general excise tax, and sales tax. After that, I will explain a few key concepts of GE T. Finally, I'll end with some of the changes that came about because of the Wayfair online sales tax case that ended in July 2018. I would like to clarify that I am not a licensed tax professional or a licensed legal professional. This information is purely for educational and informational purposes. A little bit about my background with GE T: I have worked in a few independent contractor positions here on the island of Oahu. I have also worked with a corporation where I filed GE T for their subsidiaries. In addition, I have started my own small business selling cell phone cases online. Without further ado, let's get started. We won't need my face for this presentation, so let's go to the Excel sheet that I have provided for you. In column A, you can see the different districts of the state of Hawaii as of January 1st, 2019. As mentioned earlier, the new surcharges for Kauai and the Big Island were increased. Kauai is now at 0.25% and the Big Island is at 0.25%. The state tax rate remains at 4% across the board, regardless of where you are in the state. A little side note, part of the surcharge is collected by the state in the form of a fee from each county. This is because all of the tax information is collected from one website. When you fill out your...

Award-winning PDF software

Excise tax return instructions Form: What You Should Know

In general, the tax filing deadline is due to the close of business on the 20th calendar day after you receive your tax return. However, certain provisions of the income tax code will determine when the tax due date occurs. When using Form 1120S, you may be able to file on the 23rd of the calendar month after the close of business, or the last day of the month immediately following the month in which you received your tax return. Note: You may use Form 1120S to request that the IRS pay you electronically. When filing online, the information you collect should match the information in your tax return. For example, if your tax return includes a Form W-2, an employer generally must report that information to the IRS electronically. A Form 1095-C is also used in some types of cases to report information, but does not necessarily have to match exactly what is listed on your tax return. When you use Form 1120S it must match exactly what is listed on your tax return. Once filed, Form 1120S shows the most current information. For example, if you filed your tax return before April 18, 2019, the first line of the Form 1120S should read: I am filing a joint return. Form 1095-C is the same as Form 1095-C, but is filed by an individual instead of by a partnership or corporation. If you filed form 1095-C, you should have your tax information on Form 1120S too. For more information on the tax filing deadline, see your account summary or check out our website tax/filing.html. For forms that have more specific deadlines, go to forms (find “Form 1120S” near the “Online Filing” section) and look for the date when you can expect to receive your tax information. It could be April 20, 2019, April 15, 2020, or even later in the year. If you are reporting with an accountant, you could use tax software or an agent to complete the form. See the links under When to Report.” I do not have to file my federal income tax return. To report your liability, you are responsible for filing the appropriate federal tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 637, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 637 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 637 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 637 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Excise tax return instructions